Many young Australians start their first jobs and barely think about superannuation. Most simply accept the default investment option, without really understanding the implications. But the choices made in the early years can have a huge impact on retirement savings, thanks to the power of compounding returns.

How Super Works

Superannuation is a long-term savings system where contributions from your employer (and any additional contributions you make) are invested until retirement, with the earliest date to access super currently being age 60. The money grows over time through investment returns, so the earlier you start, the more time your super has to benefit from compound growth.

Investment Options Example: Balanced vs Growth

Super funds typically offer several investment options. A balanced fund is often the default for most people and usually holds a mix of growth assets (like shares & property) and defensive assets (like term deposits & bonds). This aims to smooth returns but can limit long-term growth. A growth-focused fund allocates more to growth assets, which are often more volatile in the short-term, but historically outperform defensive assets over longer periods of time. For young people with decades until retirement, the higher risk of a growth fund is often worth the potential reward.

The Magic of Compounding returns

Compounding occurs when investment returns generate additional earnings and are reinvested, meaning you earn “growth on growth.” The longer your money is invested, the more pronounced the effect becomes. Even small differences in annual returns can have a massive impact over 30–40 years.

Example

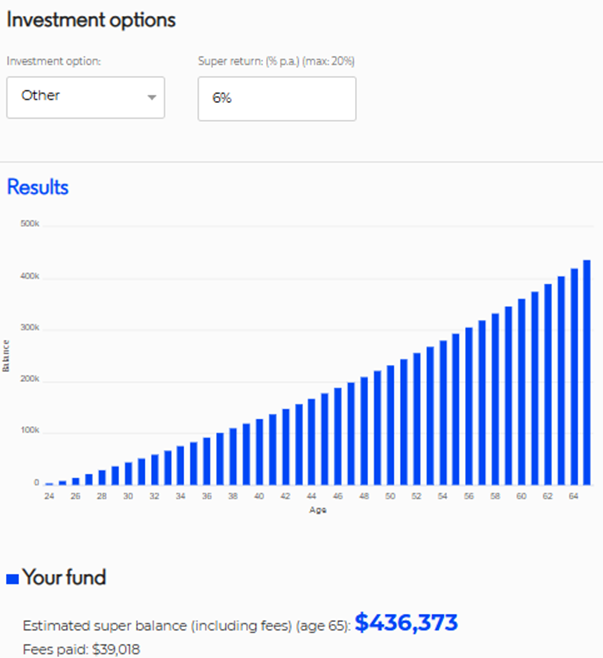

Consider a 25-year-old individual, starting their first full-time professional role with a $5,000 existing super balance and an annual salary of $70,000 until age 65. With just the compulsory 12% employer contributions over 40 years, if they invest in a balanced option averaging 6% per year, their super could grow to around $436,000 by age 65, without any additional contributions. However, if they choose a higher-growth investment option averaging 9% annually, their super could reach approximately $886,500 – a further $450,500 just by selecting a growth-focused option early.

Source: Superannuation calculator – Moneysmart.gov.au

Please note this is an example only for illustrative purposes and does not take into account individual personal circumstances. You should always seek professional advice before making any changes to your investment options.

Take Action Now

Starting early and choosing the right investment option can make a huge difference over a lifetime. We encourage young clients, adult children starting out in their first job, or anyone who isn’t aware of how the superannuation is invested to review their super and consider whether their default or current fund is right for their long-term goals.

Contact us today to discuss super investment options, model potential retirement outcomes, and set your super on the path to maximise long-term growth.